Internet-based rip-offs jumped 33 percent last year over the previous year, according to a report from a complaint center set up to monitor such crimes.

The total dollar loss from those crimes was $265 million. That's $26 million more than the price tag in 2007, the National Internet Crime Center said. For individual victims, the average amount lost was $931.

"This report illustrates that sophisticated computer fraud schemes continue to flourish as financial data migrates to the Internet," said Shawn Henry, the FBI's assistant director of the Cyber Division. ...

Henry said the figures show the need for computer users, in businesses and in homes, to be wary and use sound security practices while using the Internet.

The center said the top three most frequent complaints were about merchandise that wasn't delivered or payment that wasn't received, Internet auction fraud and credit/debit card fraud. Other scams include confidence frauds such as Ponzi schemes, check fraud, the Nigerian letter fraud and identity fraud.

Tuesday, March 31, 2009

Internet fraud up 33% in 2008

Internet fraud rose by a third last year:

Monday, March 30, 2009

Thursday, March 26, 2009

Wednesday, March 25, 2009

The Employee Free Choice Act: D.O.A.

A temporary victory for secret ballots:

ARLEN SPECTER of Pennsylvania, a moderate Republican, has more or less scuttled the chance of fundamental labour law reforms in 2009 by coming out against the Employee Free Choice Act.There's nothing free about the Employee Free Choice Act. It would take away the guaranteed right to a secret ballot when deciding whether to unionize.

Feldstein: Recession will last well into 2010

Harvard economist, former Council of Economic Advisers chairman, and former National Bureau of Economic Research president Martin Feldstein thinks the recession will not end this year:

Harvard economist, former Council of Economic Advisers chairman, and former National Bureau of Economic Research president Martin Feldstein thinks the recession will not end this year:The recession in the United States will stretch well into next year, probably raising the need for another fiscal stimulus package at least as large as the first one, prominent economist Martin Feldstein said on Tuesday.

Feldstein, a Harvard University professor who is a member of President Barack Obama's Economic Recovery Advisory Board, told Reuters that the stimulus would offset only a relatively small piece of the likely fall in spending, exports and construction.

"I'm afraid that the economy will continue to slide down well into next year," Feldstein, a former head of the National Bureau of Economic Research, said in an interview in Beijing where he was attending a conference.

"I don't know when it will end, but the forecasts that it'll end later this year I think are too optimistic," he said of the recession. ...

"The fiscal stimulus is just not large enough to offset the downward pressure that comes from reduced consumer spending. So unless somehow fixing the financial markets is enough to offset that, which I very much doubt, I think there will be a need for another fiscal stimulus package at some point," Feldstein said.

Saturday, March 21, 2009

Friday, March 20, 2009

Map of legal drinking ages around the world

Sweden does schools better

New York Times video: Even Sweden supports school choice.

Only in the U.S. is school choice a right wing vs. left wing debate. Many left-leaning European countries happily embrace school choice.

Only in the U.S. is school choice a right wing vs. left wing debate. Many left-leaning European countries happily embrace school choice.

Thursday, March 19, 2009

The U.S. economic outlook

The Times of London gives its U.S. economic outlook:

The future of the US economy hinges on whether the $2 trillion of fiscal stimulus packages work. If so, this is the path we expect the US to take:By "bottom of the recession," I think they mean the period of deepest contraction. They obviously expect the U.S. economy to continue contracting at least through the current quarter, and perhaps beyond. They also obviously expect a jobless recovery, as happened after the past two U.S. recessions.

The last quarter, in which the US economy shrank by 6.2 per cent, will have been the bottom of the recession. In the current quarter the US economy will shrink by 5.8 per cent and by the end of December the US should be out of the recession.

Unemployment, however, which stands at 8.1 per cent, is expected to continue to rise until the end of 2010 at least, while the housing slump isn’t even at the halfway stage yet. House prices, on average, have lost about a quarter of their value.

Wednesday, March 18, 2009

Meredith Whitney predicts bad year for banks

While many investors are calling a bottom in financials, banking analyst Meredith Whitney says not so fast. Meredith Whitney, in case you're unaware, was the first banking analyst to prominently point out the problems with the big banks.

A surge in borrower defaults and unemployment pressures will make 2009 an even uglier year for banks than last year, analyst Meredith Whitney said.She also predicts that U.S. home prices will fall 40%+ peak to trough. I'd say she's dead-on accurate.

She predicted "breakups and M&As on a grand scale" as the industry seeks to remake itself in the face of all its capital pressures.

"I don't think this year is going to look any better than last year," Whitney said in an interview Tuesday on CNBC. "In fact it will look worse because there's so much credit coming out of the system."

Whitney, a former analyst at Oppenheimer who recently opened her own firm, is renowned for calling out the problems with banks' toxic assets before the issue became widespread.

As some have been predicting the worst may be over for the banking sector, Whitney countered that many of the statements about some of the big banks showing profits ignore the burden that additional writedowns will pose through the year. In particular, she said Citigroup's statement that it had turned a profit the first two months of 2009 might came back to haunt it once a fuller picture was presented.

Consumers also will face pressure as unemployment grows and banks and credit card companies start calling in credit lines to avoid getting stuck with even more bad debt.

"The probability of more people going into default is higher, so the banks are going to have a tough time," she said.

Saturday, March 14, 2009

On schools, Democrats oppose economic equality

The Agitator highlights the Democrats' policy of special privileges for the rich and powerful when it comes to educating children:

Why is it that the Democrats are all about government programs to reduce inequality... except when it comes to letting poor people send their kids to the same schools the kids of politicians attend?President Obama is unwilling to have his own daughters attend public schools (both when he lived in Chicago and now that he lives in D.C.), but he is perfectly willing to condemn poor African-American and Hispanic children to an inferior education and an economically disadvantaged future.

The standardized testing data on the D.C. voucher program is inconclusive. But parents are overwhelmingly happy with the program. Which frankly is a hell of a lot better measure of its effectiveness. ...

The Democrats’ opposition to the D.C. voucher program is completely disingenuous. The program didn’t take a dime from the District’s public schools. Only New York and New Jersey spend more money per pupil than D.C. And D.C.’s public schools are horrible. Something isn’t right. And the solution isn’t to trap as many kids in those chronically failing schools as possible.

Thursday, March 12, 2009

Internet privacy law needed

Congressman Rich Boucher defends your online privacy:

US lawmakers have been itching for a good excuse to slap mandatory security guidelines on online behavioral ad targeting schemes, and apparently, they've found it.

Google's new plan introduced Wednesday to track individual users' browser history to target ads was just the ticket for Democrat Rep. Rich Boucher, the newly-minted chairman of the House subcommittee on communications and the internet.

The Virginia congressman said yesterday he's working on a bill that will put restrictions on how internet companies can collect, save, store, and share user information. ...

Boucher says he's working with other ranking members of the communications subcommittee, Republican Representatives Cliff Stearns and Joe Barton, on a bill to take privacy rules out of the hands of online ad agencies.

Friday, March 6, 2009

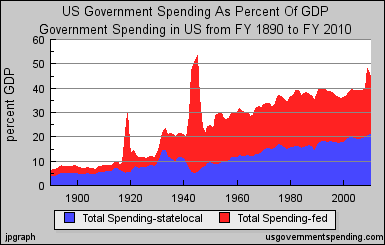

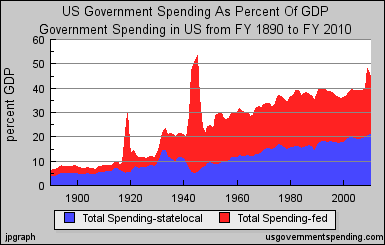

U.S. government spending as a percentage of GDP

This graph depicts state & local government spending (blue) and federal government spending (red), as a percentage of GDP, for the United States since 1890:

Source.

Source.

Source.

Source.

Thursday, March 5, 2009

A Republican alternative to Obama's health care plan

This morning on MSNBC's Morning Joe, Joe Scarborough asked what the Republicans could propose as an alternative to Obama's health care plan. That's the first time I've ever heard a Republican ask that question. The American health care system is disliked by the American public. If the Republicans don't propose a workable alternative, the Democrats will eventually win the health care debate. Someone out there please tell Joe Scarborough (and any other Republican politicians) that the answer is Singapore's health care system.

Through the use of mandatory health savings accounts, Singapore's health care system makes better use of the price system than the American health care system, which Republicans should like. This makes it cost less than the American system, while providing Singaporeans with better overall health than Americans.

From the libertarian EconLog blog:

For more info on Singapore's health care system, read here, here, here, and here.

Through the use of mandatory health savings accounts, Singapore's health care system makes better use of the price system than the American health care system, which Republicans should like. This makes it cost less than the American system, while providing Singaporeans with better overall health than Americans.

From the libertarian EconLog blog:

The Singapore government spent only 1.3 percent of GDP on healthcare in 2002, whereas the combined public and private expenditure on healthcare amounted to a low 4.3 percent of GDP. By contrast, the United States spent 14.6 percent of its GDP on healthcare that year, up from 7 percent in 1970... Yet, indicators such as infant mortality rates or years of average healthy life expectancy are slightly more favorable in Singapore than in the United States... It is true that such indicators are also related to the overall living environment and not only to healthcare spending. Nonetheless, international experts rank Singapore's healthcare system among the most successful in the world in terms of cost-effectiveness and community health results.

For more info on Singapore's health care system, read here, here, here, and here.

The cause of the housing bubble and financial crisis

Nobel Laureate Paul Krugman gives his thoughts on what caused the housing bubble and resulting financial crisis:

How did this global debt crisis happen? Why is it so widespread? The answer, I’d suggest, can be found in a speech Ben Bernanke, the Federal Reserve chairman, gave four years ago. At the time, Mr. Bernanke was trying to be reassuring. But what he said then nonetheless foreshadowed the bust to come.

The speech, titled "The Global Saving Glut and the U.S. Current Account Deficit," offered a novel explanation for the rapid rise of the U.S. trade deficit in the early 21st century. The causes, argued Mr. Bernanke, lay not in America but in Asia.

In the mid-1990s, he pointed out, the emerging economies of Asia had been major importers of capital, borrowing abroad to finance their development. But after the Asian financial crisis of 1997-98 (which seemed like a big deal at the time but looks trivial compared with what’s happening now), these countries began protecting themselves by amassing huge war chests of foreign assets, in effect exporting capital to the rest of the world.

The result was a world awash in cheap money, looking for somewhere to go.

Most of that money went to the United States — hence our giant trade deficit, because a trade deficit is the flip side of capital inflows. But as Mr. Bernanke correctly pointed out, money surged into other nations as well. In particular, a number of smaller European economies experienced capital inflows that, while much smaller in dollar terms than the flows into the United States, were much larger compared with the size of their economies. ...

For a while, the inrush of capital created the illusion of wealth in these countries, just as it did for American homeowners: asset prices were rising, currencies were strong, and everything looked fine. But bubbles always burst sooner or later, and yesterday’s miracle economies have become today’s basket cases, nations whose assets have evaporated but whose debts remain all too real. ...

If you want to know where the global crisis came from, then, think of it this way: we’re looking at the revenge of the glut.

Wednesday, March 4, 2009

Which banks will pass the stress test?

Morningstar runs its own stress test of the banks. Only half pass the test.

Harvard economist: 80% chance of avoiding depression

Robert J. Barro says there is a 20% chance this recession will become a depression, and an 80% chance that it will not:

Central questions these days are how severe will the U.S. economic downturn be and how long will it last?Update: Professor Barro has recently increased the odds of depression to 30%:

The most serious concern is that the downturn will become something worse than the largest recession of the post-World War II period — 1982, when real per capita GDP fell by 3% and the unemployment rate peaked at nearly 11%. Could we even experience a depression (defined as a decline in per-person GDP or consumption by 10% or more)? ...

There is ample reason to worry about slipping into a depression. There is a roughly one-in-five chance that U.S. GDP and consumption will fall by 10% or more, something not seen since the early 1930s. ...

In the end, we learned two things. Periods without stock-market crashes are very safe, in the sense that depressions are extremely unlikely. However, periods experiencing stock-market crashes, such as 2008-09 in the U.S., represent a serious threat. The odds are roughly one-in-five that the current recession will snowball into the macroeconomic decline of 10% or more that is the hallmark of a depression.

The bright side of a 20% depression probability is the 80% chance of avoiding a depression. The U.S. had stock-market crashes in 2000-02 (by 42%) and 1973-74 (49%) and, in each case, experienced only mild recessions. Hence, if we are lucky, the current downturn will also be moderate, though likely worse than the other U.S. post-World War II recessions, including 1982.

In this relatively favorable scenario, we may follow the path recently sketched by Federal Reserve Chairman Ben Bernanke, with the economy recovering by 2010. On the other hand, the 59 nonwar depressions in our sample have an average duration of nearly four years, which, if we have one here, means that it is likely recovery would not be substantial until 2012.

Given our situation, it is right that radical government policies should be considered if they promise to lower the probability and likely size of a depression. However, many governmental actions — including several pursued by Franklin Roosevelt during the Great Depression — can make things worse.

I wish I could be confident that the array of U.S. policies already in place and those likely forthcoming will be helpful. But I think it more likely that the economy will eventually recover despite these policies, rather than because of them.

And by examining these patterns [Barro] tells Fast Money there's a 30% chance that the current recession will snowball into an economic decline of 10% or more — the hallmark of depression.

That’s right, there’s at least a 30% chance — not one-in-five — as reported in the Journal. He's become even more bearish since the article published.

Tuesday, March 3, 2009

Bank collapse could cause financial panic in Venezuela

It looks like the anti-American dictator might have his hands full:

The collapse of a Venezuelan bank owned by R. Allen Stanford, the Texas financier accused of fraud, is raising concern that the run on its deposits could spread to other banks, threatening the nation's economy.That last sentence is classic! You've gotta love economically ignorant dictators.

On Saturday, President Hugo Chávez blamed his political enemies for rumors about mass withdrawals, and urged depositors not to pull their savings from domestic banks. ...

Mr. Chávez moved to restore confidence a day after speculation spread among brokerage-house trading desks and businessmen that at least one major bank had faced unusually large deposit withdrawals. The speculation is difficult to confirm because it is too recent to be reflected in the latest official bank data.

While Mr. Chávez may succeed in restoring confidence, the concerns underscore the problems facing the 54-year-old, anti-American former soldier, who recently completed a decade in power and last month won a referendum to alter the constitution to permit indefinite re-election.

Mr. Chávez's ability to fund welfare programs and other subsidies at the core of his popularity is undercut by plunging oil prices. Increasingly, residents of Venezuela say they believe Mr. Chávez will have to devalue the "strong bolivar" currency he introduced last year. Price controls meant to contain 30% inflation have led to food shortages. On Saturday, Mr. Chávez dispatched troops to force rice makers to boost production.

Sunday, March 1, 2009

A bubble warning from Warren Buffett

From Berkshire Hathaway's newly release shareholder letter:

The gradual decline of the housing bubble is causing this recession. Since housing is still overvalued, it will continue declining in the near term, which will continue to weaken the economy as well. When the pace of the housing decline slows, it will probably be time to go full-bore into the stock market even if the economy has not yet recovered. (The stock market typically turns upward six months before the end of a recession, and it typically turns upward rapidly.)

The investment world has gone from underpricing risk to overpricing it. This change has not been minor; the pendulum has covered an extraordinary arc. A few years ago, it would have seemed unthinkable that yields like today’s could have been obtained on good-grade municipal or corporate bonds even while risk-free governments offered near-zero returns on short-term bonds and no better than a pittance on long-terms. When the financial history of this decade is written, it will surely speak of the Internet bubble of the late 1990s and the housing bubble of the early 2000s. But the U.S. Treasury bond bubble of late 2008 may be regarded as almost equally extraordinary.I agree that intense fear has caused a high risk premium. This risk premium has caused a bubble in ultra-safe assets (i.e. government bonds) and an incredible long-term investment opportunity in riskier assets (i.e. stocks). Ordinary investors worried about the possibility of being laid off during this recession, however, have no choice but to make sure they have an unusually large emergency fund.

Clinging to cash equivalents or long-term government bonds at present yields is almost certainly a terrible policy if continued for long. Holders of these instruments, of course, have felt increasingly comfortable — in fact, almost smug — in following this policy as financial turmoil has mounted. They regard their judgment confirmed when they hear commentators proclaim "cash is king," even though that wonderful cash is earning close to nothing and will surely find its purchasing power eroded over time.

Approval, though, is not the goal of investing. In fact, approval is often counter-productive because it sedates the brain and makes it less receptive to new facts or a re-examination of conclusions formed earlier. Beware the investment activity that produces applause; the great moves are usually greeted by yawns.

The gradual decline of the housing bubble is causing this recession. Since housing is still overvalued, it will continue declining in the near term, which will continue to weaken the economy as well. When the pace of the housing decline slows, it will probably be time to go full-bore into the stock market even if the economy has not yet recovered. (The stock market typically turns upward six months before the end of a recession, and it typically turns upward rapidly.)

Subscribe to:

Comments (Atom)