Friday, December 31, 2010

Wednesday, December 29, 2010

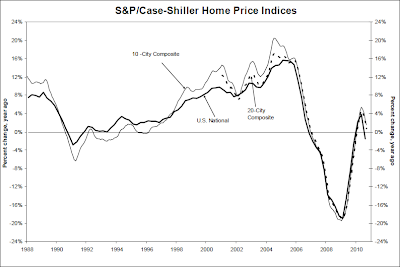

Home prices falling anew

S&P/Case-Shiller shows home prices dropping in all twenty cities tracked:

Home prices took a shockingly steep plunge on a monthly basis, an indication that the housing market could be on the verge of -- if it's not already in -- a double-dip slump.

Prices in 20 key cities fell 1.3% in October from a month earlier, an annualized decline of 15%, according to the S&P/Case-Shiller index released Tuesday. Prices were down 0.8% from 12 months earlier.

Month-over-month prices dropped in all 20 metro areas covered by the index. Six markets reached their lowest levels since the housing bust first began in 2006 and 2007.

Friday, December 24, 2010

Merry Christmas

Now you know why the U.S. Senate approved the New START treaty right before Christmas.

I'm on vacation for the next week or so. I'll be blogging again in the New Year.

Wednesday, December 22, 2010

Flat home prices expected for 2011

Economists expect home prices to be flat in 2011 after declining about 1% in 2010:

Home prices won’t show any year-over-year appreciation in 2011, according to the latest average of 110 forecasts from economists and housing analysts surveyed by MacroMarkets LLC.

The survey shows that economists expect home prices to fall by 0.17% in 2011 as measured by the S&P/Case-Shiller index of home prices in 20 U.S. cities. The average forecast for 2010 calls for the Case-Shiller index to ultimately show that home prices ended the year down 1.13%.

Overall, economists expect home prices to rise by 7.2% over the five-year period ending in 2014. In May, that forecast called for a 12% rise in prices over the span.

The effect of declining home prices on small business borrowing

The Federal Reserve Bank of Cleveland has a new economic commentary on the declining housing bubble's effect on small business borrowing. Here's the conclusion:

Everyone agrees that small business borrowing declined during the recession and has not yet returned to pre-recession levels. Lesser consensus exists around the cause of the decline. Decreased demand for credit, declining creditworthiness of small business borrowers, an unwillingness of banks to lend money to small businesses, and tightened regulatory standards on bank loans have all been offered as explanations.

While we would agree that these factors have had an effect on the decline in small business borrowing through commercial lending, we believe that other limits on the credit of small business borrowers are also at play and could be harder to offset. Specifically, the decline in home values has constrained the ability of small business owners to obtain the credit they need to finance their businesses.

Of course, not all small businesses have been equally affected by the decline in home prices. While many small business owners use residential real estate to finance businesses, not all do. Those more likely do so to include companies in the real estate and construction industries, those located in the states with the largest increases in home prices during the boom, younger and smaller businesses, companies with lesser financial prospects, and those not planning to borrow from banks. These patterns are also evident in the data sources we examined.

The link between home prices and small business credit poses important challenges for policy makers seeking to improve small business owners’ access to credit. The solution is far more complicated than telling bankers to lend more or reducing the regulatory constraints that may have caused them to cut back on their lending to small companies. Returning small business owners to pre-recession levels of credit access will require an increase in home prices or a weaning of small business owners from the use of home equity as a source of financing. Neither of those alternatives falls into the category of easy and quick solutions.

Tuesday, December 21, 2010

Lunar eclipse photo

Here's a photo I just took of tonight's lunar eclipse. The eclipse is still occurring as I write this.

Monday, December 20, 2010

What about the Silent Generation?

In discussing a new Pew Research Center study finding that Baby Boomers are feeling gloomier than other generations, CNN makes a glaring error:

The baby boomers are the generation of Americans born after World War II. What Tom Brokaw called the "greatest generation" is the generation that was in early adulthood during the Great Depression and World War II, and participated in the war effort. In between not being born and adulthood is an period called "childhood."

Americans who experienced childhood during the Great Depression or World War II are known as the "silent generation." They are too old to be baby boomers and too young to have participated in World War II. The silent generation is what makes up most of today's senior citizens, since the greatest generation has been gradually dying off for a while now.

This error was made by CNN, not the Pew Research Center.

Of course, I should point out that what we call a generation in societal terms is generally somewhat shorter than a generation in biological terms. A true generation should be about 25 years, because that's roughly the age that people in developed countries have children. But in cultural and societal terms, generations are defined by the common experiences of people within a certain age range. These common experiences are generally delineated by external events that don't neatly map to 25-year intervals.

"Most Americans are pretty glum three years into a Great Recession and a jobless recovery, but even in that context, the baby boomers stand out," said Paul Taylor, co-author of the study and vice president of the center.The "greatest generation" is not the generation that came right before the baby boomers.

In contrast, the study found only 60% of millennials — individuals between the ages of 18 and 29 — had a bleak view of the way things are going today.

And about 76% of respondents older than baby boomers, also called the "greatest generation," were dissatisfied with the status quo.

The baby boomers are the generation of Americans born after World War II. What Tom Brokaw called the "greatest generation" is the generation that was in early adulthood during the Great Depression and World War II, and participated in the war effort. In between not being born and adulthood is an period called "childhood."

Americans who experienced childhood during the Great Depression or World War II are known as the "silent generation." They are too old to be baby boomers and too young to have participated in World War II. The silent generation is what makes up most of today's senior citizens, since the greatest generation has been gradually dying off for a while now.

This error was made by CNN, not the Pew Research Center.

Of course, I should point out that what we call a generation in societal terms is generally somewhat shorter than a generation in biological terms. A true generation should be about 25 years, because that's roughly the age that people in developed countries have children. But in cultural and societal terms, generations are defined by the common experiences of people within a certain age range. These common experiences are generally delineated by external events that don't neatly map to 25-year intervals.

Thursday, December 16, 2010

Did cheap credit and easy lending cause the housing bubble? No!

Research by Edward L. Glaeser and Joshua D. Gottlieb of Harvard University, and Joseph Gyourko of the University of Pennsylvania argues that the housing bubble was not primarily caused by cheap credit and easy lending.

Abstract:

Unlike most people (including politicians and journalists who dare not blame the voters/viewers), I remember the home owners during the bubble who insisted I should buy a home because real estate is such a great investment. I remember them telling me how much their home had gone up in value. I remember them telling me I was throwing money out the window by renting. I remember being kicked out of my home because of a (failed) condo conversion by real estate investors chasing the rising prices. This is the psychology that causes bubbles! Since the collapse of the bubble, however, home buyers cannot be blamed. THEY WERE DECEIVED! THEY WERE CHEATED! Instead, they look for a scapegoat (greedy bankers) to blame for their own greedy decisions. This paper essentially says the banksters ain't to blame.

As for the initial fundamental cause of the rise in home prices, I've been going with the Bernanke explanation of a global savings glut, but this paper seems to throw a monkey wrench into that one.

Abstract:

Between 1996 and 2006, real housing prices rose by 53 percent according to the Federal Housing Finance Agency price index. One explanation of this boom is that it was caused by easy credit in the form of low real interest rates, high loan-to-value levels and permissive mortgage approvals. We revisit the standard user cost model of housing prices and conclude that the predicted impact of interest rates on prices is much lower once the model is generalized to include mean-reverting interest rates, mobility, prepayment, elastic housing supply, and credit-constrained home buyers. The modest predicted impact of interest rates on prices is in line with empirical estimates, and it suggests that lower real rates can explain only one-fifth of the rise in prices from 1996 to 2006. We also find no convincing evidence that changes in approval rates or loan-to-value levels can explain the bulk of the changes in house prices, but definitive judgments on those mechanisms cannot be made without better corrections for the endogeneity of borrowers’ decisions to apply for mortgages.Conclusion:

Interest rates do influence house prices, but they cannot provide anything close to a complete explanation of the great housing market gyrations between 1996 and 2010. Over the long 1996-2006 boom, they cannot account for more than one-fifth of the rise in house prices. Their biggest predictive influence is during the 2000-2005 period, when long rates fell by almost 200 basis points. That can account for about 45% of the run-up in home values nationally during that half-decade span. However, if one is going to cherry-pick time periods, it also must be noted that falling real rates during the 2006-2008 price bust simply cannot account for the 10% decline in FHFA indexes those years.This is essentially what I've been arguing from the beginning: The bubble was primarily the fault of home buyers who saw real estate as a way to get rich quick. Some fundamental factor in the late 1990s caused the initial rise in home prices, but then psychology (greed) took over and home buyers were willing to pay any price for a home because "real estate is the best investment you can make" and "home prices never go down." (If something is the best investment you can make and the price will never go down, then the price you pay doesn't matter.)

There is no convincing evidence from the data that approval rates or down payment requirements can explain most or all of the movement in house prices either. The aggregate data on these variables show no trend increase in approval rates or trend decrease in down payment requirements during the long boom in prices from 1996-2006. However, the number of applications and actual borrowers did trend up over this period (and fall sharply during the bust), which raises the possibility that the nature of the marginal buyer was changing over time. Carefully controlling for that requires better and different data, so our results need not be the final word on these two credit market traits.

This leaves us in the uncomfortable position of claiming that one plausible explanation for the house price boom and bust, the rise and fall of easy credit, cannot account for the majority of the price changes, without being able to offer a compelling alternative hypothesis. The work of Case and Shiller (2003) suggests that home buyers had wildly unrealistic expectations about future price appreciation during the boom. They report that 83 to 95 percent of purchasers in 2003 thought that prices would rise by an average of around 9 percent per year over the next decade. It is easy to imagine that such exuberance played a significant role in fueling the boom.

Yet, even if Case and Shiller are correct, and over-optimism was critical, this merely pushes the puzzle back a step. Why were buyers so overly optimistic about prices? Why did that optimism show up during the early years of the past decade and why did it show up in some markets but not others? Irrational expectations are clearly not exogenous, so what explains them? This seems like a pressing topic for future research.

Moreover, since we do not understand the process that creates and sustains irrational beliefs, we cannot be confident that a different interest rate policy wouldn’t have stopped the bubble at some earlier stage. It is certainly conceivable that a sharp rise in interest rates in 2004 would have let the air out of the bubble. But this is mere speculation that only highlights the need for further research focusing on the interplay between bubbles, beliefs and credit market conditions.

Unlike most people (including politicians and journalists who dare not blame the voters/viewers), I remember the home owners during the bubble who insisted I should buy a home because real estate is such a great investment. I remember them telling me how much their home had gone up in value. I remember them telling me I was throwing money out the window by renting. I remember being kicked out of my home because of a (failed) condo conversion by real estate investors chasing the rising prices. This is the psychology that causes bubbles! Since the collapse of the bubble, however, home buyers cannot be blamed. THEY WERE DECEIVED! THEY WERE CHEATED! Instead, they look for a scapegoat (greedy bankers) to blame for their own greedy decisions. This paper essentially says the banksters ain't to blame.

As for the initial fundamental cause of the rise in home prices, I've been going with the Bernanke explanation of a global savings glut, but this paper seems to throw a monkey wrench into that one.

Wednesday, December 15, 2010

What factors create better schools? Lessons from the international tests...

Asia-Pacific economies absolutely dominated the most recent PISA international student assessment tests.

Shanghai, China took the top spot in all three subject areas—reading, math, and science. Other Asia-Pacific outperformers were South Korea, Hong Kong, Singapore, New Zealand, Japan and Australia.

Our neighbor to the north, Canada, also outperformed the international average in all three subject areas. The United States, however, was mediocre. So were the big five European Union countries—Germany, France, United Kingdom, Italy and Spain.

Here are some finding from the OECD about what causes educational outperformance:

Shanghai, China took the top spot in all three subject areas—reading, math, and science. Other Asia-Pacific outperformers were South Korea, Hong Kong, Singapore, New Zealand, Japan and Australia.

Our neighbor to the north, Canada, also outperformed the international average in all three subject areas. The United States, however, was mediocre. So were the big five European Union countries—Germany, France, United Kingdom, Italy and Spain.

Here are some finding from the OECD about what causes educational outperformance:

- Successful school systems provide all students, regardless of their socio-economic backgrounds, with similar opportunities to learn.

- Most successful school systems grant greater autonomy to individual schools to design curricula and establish assessment policies, but these school systems do not necessarily allow schools to compete for enrolment.

- School systems considered successful tend to prioritise teachers’ pay over smaller classes.

- The greater the prevalence of standards-based external examinations, the better the performance.

- Schools with better disciplinary climates, more positive behaviour among teachers and better teacher-student relations tend to achieve higher scores in reading.

- After accounting for the socio-economic and demographic profiles of students and schools, students in OECD countries who attend private schools show performance that is similar to that of students enrolled in public schools.

Tuesday, December 14, 2010

Health insurance mandate ruled unconstitutional

Ilya Shapiro explains the constitutional significance:

Today is a good day for liberty. By striking down the unprecedented requirement that Americans buy health insurance — the "individual mandate" — Judge Henry Hudson vindicated the idea that ours is a government of delegated and enumerated, and thus limited, powers.

But this should not be surprising, for the Constitution does not grant the federal government the power to force private commercial transactions.

Even if the Supreme Court has broadened the scope of Congress' authority under the Commerce Clause — it can now reach local activities that have a substantial effect on interstate commerce — never before has it allowed people to face a civil penalty for declining to buy a particular product. Hudson found therefore that the individual mandate "is neither within the letter nor the spirit of the Constitution."

Stated another way, every exercise of Congress' power to regulate interstate commerce has involved some form of action or transaction engaged in by an individual or legal entity. The government's theory — that the decision not to buy insurance is an economic one that affects interstate commerce in various ways — would, for the first time ever, permit laws commanding people to engage in economic activity.

Under such a reading, which judges in two other cases have unfortunately adopted, nobody would ever be able to plausibly claim that the Constitution limits congressional power. The federal government would then have wide authority to require that Americans engage in activities ranging from eating spinach and joining gyms (in the health care realm) to buying GM cars. Congress could tell people what to study or what job to take...

As for the oft-invoked car insurance analogy, being required to buy insurance if you choose to drive is different from having to buy it because you are alive. And it is states that impose car insurance mandates, under their general police powers — which the federal government lacks. ...

As Hudson said, "Despite the laudable intentions of Congress in enacting a comprehensive and transformative health care regime, the legislative process must still operate within constitutional bounds. Salutatory goals and creative drafting have never been sufficient to offset an absence of enumerated powers."

Monday, December 13, 2010

Why "Saving the Earth" is stupid

Yes, climate change exists. And, yes, most climate scientists and environmental scientists believe it is primarily caused by human activity. And, yes, we should try to do something about it. But environmentalists are prone to exaggerated language. One of those exaggerations is the idea that preventing further global warming is "Saving the Earth."

Yes, climate change exists. And, yes, most climate scientists and environmental scientists believe it is primarily caused by human activity. And, yes, we should try to do something about it. But environmentalists are prone to exaggerated language. One of those exaggerations is the idea that preventing further global warming is "Saving the Earth."The Earth has been around for a long time. During that time it has been through quite a lot. It has been struck by multiple asteroids. It was once struck so violently that

Even during times when life existed, the Earth has been far warmer than it is today. The global climate was much warmer when the dinosaurs roamed the Earth than it is now. It was the global cooling that occurred after another asteroid strike around 65.5 million years ago that gave rise to warm-blooded mammals.

This graph shows estimated global temperatures during the Phanerozoic Eon, the period during which abundant animal life has existed on Earth. Notice that we are in one of the cooler periods.

Global warming is primarily a threat to mammals. (Remember, humans are mammals.) Under global warming, vegetation will thrive. So will cold-blooded animals such as insects and reptiles. Rising ocean levels will benefit fish as well. It is us, the mammals, who are at risk. As far as humans are concerned, it is primarily a risk to people in poor countries. Therefore, the environmentalist message shouldn't be "Save the Earth," it should be "Save the Mammals."

Global warming is primarily a threat to mammals. (Remember, humans are mammals.) Under global warming, vegetation will thrive. So will cold-blooded animals such as insects and reptiles. Rising ocean levels will benefit fish as well. It is us, the mammals, who are at risk. As far as humans are concerned, it is primarily a risk to people in poor countries. Therefore, the environmentalist message shouldn't be "Save the Earth," it should be "Save the Mammals."Minimizing global climate change may save many mammals, perhaps even humans. But fear not for the Earth! Regardless of its climate, it will continue to happily orbit the sun for billions of years to come.

Saturday, December 11, 2010

How Shanghai dominated the international student achievement test

On the most recent PISA international student assessment tests, Shanghai, China took the top spot in all three subject areas—reading, math, and science.

Here's how Shanghai, the top performer, gets its students to achieve:

Here's how Shanghai, the top performer, gets its students to achieve:

When the results of an international education assessment put Shanghai and several other Asian participants ahead of the US and much of Western Europe, many Americans were shocked. ...

Shanghai trounced the OECD average: in reading, it got a 556, versus a 493 OECD average; in science, the score was 575 versus 501; and in math, there was a difference of more than 100 points – a 600 in Shanghai versus a 496 average. ... The results left many observers with one question: How did they do it? ...

Experts ascribe Shanghai’s success to China's assessment that academic achievement is foremost the result of hard work rather than a good teacher or innate talent.

“Students not only work harder, but they attribute their academic success to their own work,” says James Stigler, a professor of psychology at UCLA who has conducted research on the Chinese educational system. “Chinese students say the most important factor is studying hard. They really believe that’s the root of success in learning.”

That emphasis on hard work is complemented by several other key practices: active engagement by parents, early efforts to build up attention spans, and families' emphasis on spending long hours in school and on homework while doing little else. ...

Dr. Miller, a longtime observer of the Chinese educational system, has seen sweeping differences in the classroom.

In one study, he sat in first-grade math classes in the US and in Beijing and tracked the number of students who were paying attention throughout the lesson. At the end, about 90 percent of Chinese first graders were still following the lesson. Only about half of the Americans were.

The phenomenon was noted in the PISA report as well: “Typically in a Shanghai classroom, students are fully occupied and fully engaged. Non-attentive students are not tolerated,” it said.

The difference in instructional techniques plays a big role, Miller says. Chinese teachers tended to spend a long time giving instructions in the beginning, while American teachers gave cursory instructions then corrected students as the lesson continued. American students’ attention wandered when they became confused.

Another difference, particularly in math instruction, stood out to both Dr. Stigler and Miller. The US teaches procedurally in math, they noted – repetition of the same procedures until a student can remember reflexively how to solve a particular type of math problem. In China, students are encouraged to understand the connections between each step of the problem so that they can think their way through them, even if the order is forgotten.

In the US, we “do things over and over again until they sink in,” Miller says. “You don’t really know something until you can explain why you do this, why you don’t do that.”

Once one student in the classroom explains a problem correctly, the next student has to explain it, too. That is often repeated until most or all of the students can confidently work their way through a problem, Miller says. It’s a bit different from the US practice of calling on one or two raised hands, then moving on.

Friday, December 10, 2010

Four more years of housing stagnation expected

RealtyTrac and Trulia expect continuing housing market stagnation:

The housing market will remain depressed, with record high foreclosure levels, rising mortgage rates and a glut of distressed properties dampening the market for years to come, industry experts predicted on Tuesday.

"We don't see a full market recovery until 2014," said Rick Sharga of RealtyTrac, a foreclosure marketplace and tracking service. He said that he expected more than 3 million homeowners to receive foreclosure notices in 2010, with more than 1 million homes being seized by banks before the end of the year.

Both of those numbers are records and expected to go even higher, as $300 billion in adjustable rate loans reset and foreclosures that had been held up by the robo-signing scandal work through the process. That should make the first quarter of 2011 even uglier than the fourth quarter of 2010, he said. ...

Mortgage rates will start to rise in 2011, further dampening demand and limiting affordability, said Pete Flint, chief executive of Trulia.com, a real estate search and research website. "Nationally, prices will decline between 5 percent and 7 percent, with most of the decline occurring in the first half of next year," he said.

Thursday, December 9, 2010

Green jobs training: The road to unemployment

Green jobs are political marketing, not reality. Workers who believed the hype and retrained for these largely non-existent jobs are finding themselves unemployable:

Green jobs are political marketing, not reality. Workers who believed the hype and retrained for these largely non-existent jobs are finding themselves unemployable:After losing his way in the old economy, Laurance Anton tried to assure his place in the new one by signing up for green jobs training earlier this year at his local community college.If you don't substantially raise the price of carbon, people will continue to get the vast majority of their energy from fossil fuels. Even if you do substantially raise the cost of fossil fuels, the "green jobs" created will likely be less than the "black jobs" lost.* That's because energy conservation—using less energy—is an essential part of reducing carbon emissions. Using less energy means that the energy industry must shrink as a percentage of GDP, while other industries grow as a percentage of GDP. The "black jobs" lost would be completely offset by more jobs elsewhere in the economy, but it is a mistake to assume that they would all be in green jobs. Many of them will be in other industries entirely.

Anton has been out of work since 2008, when his job as a surveyor vanished with Florida's once-sizzling housing market. After a futile search, at age 56 he reluctantly returned to school to learn the kind of job skills the Obama administration is wagering will soon fuel an employment boom: solar installation, sustainable landscape design, recycling and green demolition.

Anton said the classes, funded with a $2.9 million federal grant to Ocala's workforce development organization, have taught him a lot. He's learned how to apply Ohm's law, how to solder tiny components on circuit boards and how to disassemble rather than demolish a building.

The only problem is that his new skills have not resulted in a single job offer. Officials who run Ocala's green jobs training program say the same is true for three-quarters of their first 100 graduates.

"I think I have put in 200 applications," said Anton, who exhausted his unemployment benefits months ago and now relies on food stamps and his dwindling savings to survive. "I'm long past the point where I need some regular income." ...

The industry's growth has been undercut by the simple economic fact that fossil fuels remain cheaper than renewables.

The Obama administration has completely missed its opportunity to raise the price of carbon. If it didn't happen when Democrats controlled the House of Representatives, it won't happen with Republicans in control. Democrats seem to think that reducing carbon emissions, fighting global warming, creating "green jobs," and promoting "energy independence" can occur completely through wishful thinking. It cannot. The price of carbon must go up.

Hat tip: Jeffrey Miron

* Since oil, coal, and soot are black, I figure "black jobs" is the best complementary term to "green jobs."

Wednesday, December 8, 2010

CNBC housing debate

In the video, Susan Wachter is misleading. Price-to-rent ratios are out of line, not just by 1890 levels, but also by 1970-1999 levels—basically all of the pre-bubble period. From 2007-2008, prices were falling rapidly until the Federal government stepped in to prop them up.

Tuesday, December 7, 2010

Tea Party leader: Renters should have no right to vote

Judson Phillips, the president of Tea Party Nation, on renters' right to vote:

The Founding Fathers originally said they put certain restrictions on who got the right to vote. It wasn’t you were just a citizen and you automatically got to vote. Some of the restrictions, you know, you obviously would not think about today. But one of them was you had to be a property owner. And that makes a lot of sense, because if you’re a property owner you actually have a vested stake in the community. If you’re not a property owner, you know, I’m sorry but property owners have a little bit more of a vested stake in the community than non-property owners do.And many libertarians think the Tea Party is a pro-liberty movement?! It's not. It's an anti-libertarian, social conservative movement.

Monday, December 6, 2010

Thoughts on unemployment insurance and the mean duration of unemployment

Harvard economics professor Greg Mankiw provides his thoughts on the optimal duration of unemployment insurance (UI) during an economic downturn:

The median duration of unemployment is currently 21.6 weeks. That means 50% of all unemployed workers are finding jobs within that span of time. (By comparison, the mean is currently 33.8 weeks.) When half of all unemployed workers find jobs within 21.6 weeks, providing 99 weeks of unemployment insurance seems a bit excessive to me. Sure, some people are naturally more employable than others. The less education people have, the higher their chances of being unemployed. College graduates probably find new jobs quickly while high school dropouts take much longer. For this reason, the mean is probably a better guide than the median.

I'll suggest a simple policy rule:

The length of unemployment insurance should automatically adjust throughout the business cycle. It should provide full benefits until 1x the mean duration of unemployment, then decline [not necessarily linearly] until being discontinued at 2x the mean duration of unemployment.

Because the mean duration of unemployment is considerably longer than the median, this will provide most unemployed workers with full unemployment benefits during the entire time they're unemployed. Those workers who don't find jobs will gradually be given stronger economic incentives to look harder and lower their standards. Workers who are still unemployed after 2x the mean duration of unemployment are significant outliers, and would be cut off, although welfare may still be available to them if they truly need it.

A downside to the rule above as stated is that it will tend to hit poorly-educated workers the hardest, because they are less employable than most workers. I'm not dogmatic about the rule. It's really just a suggestion. A simpler and more generous version would provide full benefits until 2x the mean duration of unemployment, ending with a sharp cutoff point. The key is that the length of unemployment insurance benefits should automatically adjust throughout the business cycle, using mean (preferably) or median duration of unemployment as a guide.

Let me also suggest a second policy rule:

The amount (i.e. dollars per week) of unemployment insurance benefits people receive should also vary throughout the business cycle. The amount they get should automatically go up or down in inverse proportion to the output gap, with the default level assuming an output gap of zero.

With this second policy rule, when the economy is weak payment amounts would go up, providing an extra economic stimulus; when the economy is strong, payment amounts would go down to incentivize the unemployed to take one of the many jobs available.

Update: Bentley University economics professor Scott Sumner writes in:

UI has pros and cons. The pros are that it reduces households' income uncertainty and that it props up aggregate demand when the economy goes into a downturn. The cons are that it has a budgetary cost (and thus, other things equal, means higher tax rates now or later) and that it reduces the job search efforts of the unemployed. To me, all these pros and cons seem significant. I have yet to see a compelling quantitative analysis of the pros and cons that informs me about how generous the optimal system would be.The thought I've been kicking around recently is that the length of unemployment insurance should automatically adjust based on either the mean or median duration of unemployment. My hypothesis is that the economic optimum is likely within the range of 1x and 2x the mean (average) duration of unemployment.

So when I hear economists advocate the extension of UI to 99 weeks, I am tempted to ask, would you also favor a further extension to 199 weeks, or 299 weeks, or 1099 weeks? If 99 weeks is better than 26 weeks, but 199 is too much, how do you know?

It is plausible to me that UI benefits should last longer when the economy is weak. The need for increased aggregate demand is greater, and the impact on job search may be weaker. But this conclusion is hardly enough to tell us whether 99 weeks is too much, too little, or about right.

The median duration of unemployment is currently 21.6 weeks. That means 50% of all unemployed workers are finding jobs within that span of time. (By comparison, the mean is currently 33.8 weeks.) When half of all unemployed workers find jobs within 21.6 weeks, providing 99 weeks of unemployment insurance seems a bit excessive to me. Sure, some people are naturally more employable than others. The less education people have, the higher their chances of being unemployed. College graduates probably find new jobs quickly while high school dropouts take much longer. For this reason, the mean is probably a better guide than the median.

I'll suggest a simple policy rule:

The length of unemployment insurance should automatically adjust throughout the business cycle. It should provide full benefits until 1x the mean duration of unemployment, then decline [not necessarily linearly] until being discontinued at 2x the mean duration of unemployment.

Because the mean duration of unemployment is considerably longer than the median, this will provide most unemployed workers with full unemployment benefits during the entire time they're unemployed. Those workers who don't find jobs will gradually be given stronger economic incentives to look harder and lower their standards. Workers who are still unemployed after 2x the mean duration of unemployment are significant outliers, and would be cut off, although welfare may still be available to them if they truly need it.

A downside to the rule above as stated is that it will tend to hit poorly-educated workers the hardest, because they are less employable than most workers. I'm not dogmatic about the rule. It's really just a suggestion. A simpler and more generous version would provide full benefits until 2x the mean duration of unemployment, ending with a sharp cutoff point. The key is that the length of unemployment insurance benefits should automatically adjust throughout the business cycle, using mean (preferably) or median duration of unemployment as a guide.

Let me also suggest a second policy rule:

The amount (i.e. dollars per week) of unemployment insurance benefits people receive should also vary throughout the business cycle. The amount they get should automatically go up or down in inverse proportion to the output gap, with the default level assuming an output gap of zero.

With this second policy rule, when the economy is weak payment amounts would go up, providing an extra economic stimulus; when the economy is strong, payment amounts would go down to incentivize the unemployed to take one of the many jobs available.

Update: Bentley University economics professor Scott Sumner writes in:

I favor a self insurance approach. Each worker contributes 10% of their income into a private UI account, which they can draw from when unemployed. Any funds not used can be allocated to retirement. This avoids the problem of UI acting as a disincentive to find work.

Sunday, December 5, 2010

2010 is one of the warmest years on record so far

The first eleven months of 2010 are leading it to be one of the warmest years on record:

The first eleven months of 2010 are leading it to be one of the warmest years on record:This year is on track to enter the almanac as one of the three warmest years on record globally, along with 1998 and 2005, according to a preliminary analysis by the World Meteorological Organization.The public debate about climate change is so intertwined with politics that I try to avoid politically-motivated arguments on the subject. I've never watched Al Gore's documentary, An Inconvenient Truth, because he's an environmental activist, not a climate scientist. I prefer to get my information from reputable scientific sources such as the National Academy of Science. Instead of An Inconvenient Truth, I watched the Teaching Company DVD series Earth's Changing Climate by Prof. Richard Wolfson of Middlebury College, available at your local library. These sources concur with the U.N. Intergovernmental Panel on Climate Change, but are not as alarmist as environmental activists.

Not only that, but 2010 stands a decent chance of capturing the record, depending on temperature data from November and December, according to Michel Jarraud, secretary-general of the WMO. Global average temperatures for the first 10 months of the year are running slightly ahead of those for the same period in '98 and '05...

Preliminary temperature data for November are comparable to temperatures seen in November 2005, indicating they have remained near record levels as the year winds down.

Even if 2010 fails to capture the top spot, the first decade of the 21st century already has gone into the books as the warmest since 1850, when the instrument record began. ...

Some climate scientists caution that any one year's worth of events is driven more by natural variability than by long-term warming triggered by the released of carbon dioxide from burning fossils fuel. But when 2010's extreme events are seen in that broader context, they appear to fit long-term patterns the climate models have generally projected for a climate system responding to increasing atmospheric concentrations of greenhouse gases.

A range of studies have documented an increase in extreme heat events, a decrease in extreme cold events, and an increase in rainfall and snowfall intensity globally during the past 50 years...

Republicans attack the IPCC as biased, but the IPCC is not alone in its conclusions. As Science Magazine, published by the American Association for the Advancement of Science, once stated:

IPCC is not alone in its conclusions. In recent years, all major scientific bodies in the United States whose members' expertise bears directly on the matter have issued similar statements. ... Politicians, economists, journalists, and others may have the impression of confusion, disagreement, or discord among climate scientists, but that impression is incorrect.Here's a graph of global temperatures from 1850-2008:

Knowing that anthropological climate change exists and doing something productive about it are two different issues. Harvard economist Greg Mankiw has a simple solution. Raise carbon taxes, and then reduce other taxes so that the overall tax burden on the American economy doesn't change.

Knowing that anthropological climate change exists and doing something productive about it are two different issues. Harvard economist Greg Mankiw has a simple solution. Raise carbon taxes, and then reduce other taxes so that the overall tax burden on the American economy doesn't change.

Saturday, December 4, 2010

Ron Paul defends Wikileaks... and freedom

Congressman Ron Paul defends Wikileaks:

Congressman Ron Paul defends Wikileaks:In a free society we're supposed to know the truth. In a society where truth becomes treason, then we're in big trouble. And now, people who are revealing the truth are getting into trouble for it.The people attacking Wikileaks—and calling for the murder of its founder—are the enemies of freedom.

Thursday, December 2, 2010

House hunters afraid to buy

From CNNMoney:

One reason mortgage interest rates are so low is because inflation is abnormally low, so real mortgage rates aren't as low as they appear. In fact, we currently have the lowest level of core inflation on record. Here's a graph:

Despite some of the best home-buying conditions in years— affordable prices, low interest rates and lots of choices — fear of buying has infected the market.Despite what the real estate cheerleading in the article would leave you to believe, there's still a housing bubble. In much of the U.S., homes are still overvalued. There's good reason not to buy.

It has paralyzed house hunters, making them unable to pull the trigger even on attractive deals. Some are worried about making the payments, while others are convinced they'll save even more if they wait.

It's perfectly natural that they should feel that way in the wake of the housing bust, said Lawrence Yun, the chief economist for the National Association of Realtors. "It's like when the stock market is crashing," he said. "People are waiting to see if deals will get better."

In fact, home sales are down by about 25% from last year, which means a lot of people are sitting on the sidelines. And real estate agents are having to get used to the fear of buying trend.

One reason mortgage interest rates are so low is because inflation is abnormally low, so real mortgage rates aren't as low as they appear. In fact, we currently have the lowest level of core inflation on record. Here's a graph:

Wednesday, December 1, 2010

U.S. house prices fell 1.5% in Q3 2010

According to S&P/Case-Shiller, U.S. house prices fell 1.5% in the third quarter of 2010 compared to a year earlier:

Data through September 2010, released today by Standard & Poor’s for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, show that the U.S. National Home Price Index declined 2.0% in the third quarter of 2010, after having risen 4.7% in the second quarter. Nationally, home prices are 1.5% below their year-earlier levels. In September, 18 of the 20 MSAs covered by S&P/Case-Shiller Home Price Indices and both monthly composites were down; and only the two composites and five MSAs showed year-over-year gains. While housing prices are still above their spring 2009 lows, the end of the tax incentives and still active foreclosures appear to be weighing down the market.

The chart above depicts the annual returns of the U.S. National, the 10-City Composite and the 20-City Composite Home Price Indices. The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 1.5% decline in the third quarter of 2010 over the third quarter of 2009. In September, the 10-City and 20-City Composites recorded annual returns of +1.6% and +0.6%, respectively. These two indices are reported at a monthly frequency and September was the fourth consecutive month where the annual growth rates moderated from their prior month’s pace, confirming a clear deceleration in home price returns.

Tuesday, November 30, 2010

Yes, money buys happiness

It's an old saying, "Money doesn't buy happiness." But, it turns out it might not be true. Higher incomes are associated with greater happiness across countries. According to The Economist, the key to spotting the correlation is to use a logarithmic scale rather than a linear one.

It's an old saying, "Money doesn't buy happiness." But, it turns out it might not be true. Higher incomes are associated with greater happiness across countries. According to The Economist, the key to spotting the correlation is to use a logarithmic scale rather than a linear one.[Economists] who look at happiness often contend that, beyond a GDP per capita of just $15,000 (measured at purchasing-power parity), money does not buy happiness. ... But plot the data another way, on a logarithmic scale where each increment represents a 100% increase in income per head, and the relationship between wealth and happiness looks more robust.Myth busted, apparently.

Monday, November 29, 2010

Pass the DREAM Act

Immigrants built this country. They will continue building it if a xenophobic public doesn't kick them out. College graduates are especially beneficial to the U.S. economy. We should encourage immigrants, even undocumented immigrants, to graduate from college and then stay here.

Thursday, November 25, 2010

New home sales down 28.5%, building permits down 4.2% in October 2010

New single-family home sales fell 28.5% year-over-year in October, from 396,000 in October 2009. Month-over-month, the decline was 8.1%:

New home sales tumbled in October while the median home price dropped to the lowest point in seven years.Building permits are down 4.2% year-over-year.

Sales of new single-family homes declined 8.1 percent to a seasonally adjusted annual rate of 283,000 units in October, the Commerce Department reported Wednesday.

It was the fourth time the sales rate has dropped in the past six months. New home sales are just 2.9 percent above August's pace of 275,000 units — the lowest level on records dating back to 1963.

Top 10 cities where home prices have improved most (or fallen least) in the past year

Many economists believe it could take three years for the industry to get back to a healthy annual rate of sales of around 600,000 homes.

The median price of a home sold in October dipped to $194,900, the lowest level since October 2003.

Wednesday, November 24, 2010

Mankiw: Eliminate the mortgage interest deduction

Harvard economics professor Greg Mankiw advocates eliminating the mortgage interest tax deduction:

One major tax expenditure that the Bowles-Simpson [deficit reduction] plan would curtail or eliminate is the mortgage interest deduction. Without doubt, many homeowners and the real estate industry will object. But they won’t have the merits on their side.

This subsidy to homeownership is neither economically efficient nor particularly equitable. Economists have long pointed out that tax subsidies to housing, together with the high taxes on corporations, cause too much of the economy’s capital stock to be tied up in residential structures and too little in corporate capital. This misallocation of resources results in lower productivity and reduced real wages.

Moreover, there is nothing particularly ignoble about renting that deserves the scorn of the tax code. But let’s face it: subsidizing homeowners is the same as penalizing renters. In the end, someone has to pick up the tab.

Tuesday, November 23, 2010

Real estate shadow inventory up 10% year-over-year

There is now an 8-month supply of shadow inventory:

There is now an 8-month supply of shadow inventory:There's a large number of homes, either already repossessed by lenders or very seriously delinquent, that are poised to be added to the already glutted regular supply of homes on the market.For several years now, we've been hearing about how all this shadow inventory was going to hit the market and push down prices. I'm starting to think someone's crying wolf. (You remember how The Boy Who Cried Wolf ends, right?)

This "shadow inventory" jumped 10% during the past year, to an eight-month supply at the current rate of home sales, according to a report issued Monday.

According to CoreLogic, a financial information provider, there were 2.1 million homes in this uncounted inventory as of the end of August, up from 1.9 million units 12 months earlier.

Adding the shadow inventory to the visible supply of homes on the market boosted the total housing-market supply to 6.3 million units from 6.1 million in August 2009. At the current sales rate, it would take 23 months to go through the entire visible and shadow inventory of homes — more than three times the normal rate of six to seven months.

The potential extra supply raises the risk of further home price declines, according to Mark Fleming, CoreLogic's chief economist.

Monday, November 22, 2010

Glaeser: Scale back the mortgage interest deduction

Harvard University economics professor Edward Glaeser argues for scaling back the home mortgage interest tax deduction:

REDUCING THE national debt is a great test of our political system. ... Yet last week’s eminently sensible preliminary report of the bipartisan National Commission on Fiscal Responsibility and Reform seems to have brought forth not careful consideration but flights of fury. In particular, the possibility of reforming the home mortgage interest deduction has generated a torrent of ire. While one option mentioned by the report was to eliminate all tax deductions and credits, the more detailed Wyden-Gregg option is to limit the mortgage deduction to exclude second homes, home equity lines, and mortgages over $500,000. Lowering the upper limit on the home mortgage interest deduction should appeal to progressives, who want less largess for the wealthy, and to small-government conservatives, who dislike public paternalism. Unfortunately, the demons of discord seem to have prevented either group from embracing the reform.

The Democrats are haunted by a blue leviathan that calls for massive government transfers for any vaguely middle-class interest group. That monster was working full force last week as progressive pundits argued that capping the mortgage interest deduction at $500,000 would be deeply unfair to middle-class homeowners. Apparently these writers think that the middle class is full of people with million-dollar mortgages. According to the 2007 Survey of Consumer Finance, the median mortgage owed by a family in the top 10 percent of the US income distribution was $200,000. The median price of an existing home sold in September was $171,000. Research by economists James Poterba and Todd Sinai finds that even among households earning more than $250,000, the average mortgage is $300,000.

If liberals defend the home mortgage deduction as a vital bulwark for middle income Americans, then they are ignoring the fact that the home mortgage interest deduction is one of the most regressive parts of the tax code. Poterba and Sinai’s research finds that the average benefit created by the deduction for home-owning families earning over $250,000 is 10 times larger than the average benefit reaped by families earning between $40,000 and $75,000. Progressives also typically worry about global warming, and that concern should lead them to oppose any tax policy, like the mortgage interest deduction, that encourages Americans to build bigger, more energy-intensive homes. ...

Tea Party libertarians should fight the deduction, opposing any use of tax policy to try to manipulate the way we live. Why is it the government’s business to try to bribe us to buy bigger homes and take on more debt? ...

Reforming the home mortgage interest deduction is a good place for both parties to start getting serious.

Monday, November 15, 2010

Can you balance the federal budget?

Here's a graph of federal debt held by the public as a percentage of GDP, from 1970-2009:

With the exception of a few short years at the end of the Clinton administration, politicians have been unable to balance the federal budget for decades. The massive rise in U.S. national debt began under President Reagan as he cut taxes and raised defense spending. Now President Obama's National Commission on Fiscal Responsibility and Reform has proposed to reduce the budget deficit in the medium term (5 year) and balance the budget over the long run (27 years).

Can you do it? The New York Times has a fun little tool to let you try balancing the budget. I did it quite easily, in both the medium term and the long term—and then I just kept going. Through a mix of 70% spending cuts and 30% tax increases, I was able to give the U.S. a budget surplus of over $625 billion in 2030. Try it yourself. If you can't make decisions that balance the federal budget, don't get upset at politicians for being unable to do so. (Hint: Economists project that the long-term growth in federal spending comes mostly from increased entitlement spending as baby boomers enter retirement.)

With the exception of a few short years at the end of the Clinton administration, politicians have been unable to balance the federal budget for decades. The massive rise in U.S. national debt began under President Reagan as he cut taxes and raised defense spending. Now President Obama's National Commission on Fiscal Responsibility and Reform has proposed to reduce the budget deficit in the medium term (5 year) and balance the budget over the long run (27 years).

Can you do it? The New York Times has a fun little tool to let you try balancing the budget. I did it quite easily, in both the medium term and the long term—and then I just kept going. Through a mix of 70% spending cuts and 30% tax increases, I was able to give the U.S. a budget surplus of over $625 billion in 2030. Try it yourself. If you can't make decisions that balance the federal budget, don't get upset at politicians for being unable to do so. (Hint: Economists project that the long-term growth in federal spending comes mostly from increased entitlement spending as baby boomers enter retirement.)

Sunday, November 14, 2010

Progressives at war with the facts

In a recent New York Times column calling the United States a banana republic, Nicholas Kristof writes:

However, Kristof's column reflects something I find quite troubling about the left's concern with "economic inequality." Modern-day progressives appear to be far more concerned with the fact that some people are rich than that some people are poor. You see this throughout Kristof's column. He never once uses the words "poor" or "poverty" in the column, however, he repeatedly complains about the rich:

Second, the prospect of becoming rich is one of the main reasons people give up the security of a salaried job in order to create a new business. Starting a new business is risky. Most businesses fail in the first year. Reduce the financial incentive and you will have fewer new businesses, which in turn will create fewer high-paying jobs.

Third, taking money from the rich and redistributing it to the middle class—the progressive agenda ever since Bill Clinton took office—does nothing to help the poor. It's just a modern way of buying votes.

Fourth, Nicholas Kristof's column is misleading because it only focuses on inequality. The problem with Nicaragua, Venezuela and Guyana is not that a few people are rich, it's that the bulk of the population is poor and undereducated. According to the United Nations Development Programme, the United States ranks 9th in the world in terms of per capita income, beaten only by relatively small countries. By contrast, Nicaragua ranks #135, Venezuela ranks #71, and Guyana ranks #128. In terms of education, the United States ranks #5, compared to Nicaragua at #118, Venezuela at #104, and Guyana at #85.

On the overall United Nations Human Development Index for 2010, the United States ranks 4th in the world, beating all 27 members of the European Union.

Personally, poverty troubles me. Inequality does not.

Data source.

The United States now arguably has a more unequal distribution of wealth than traditional banana republics like Nicaragua, Venezuela and Guyana.According to the United Nations Development Programme, this is simply false. They rank the United States at #42 out of 133 countries. Nicaragua ranks #93, Venezuela ranks #65, and Guyana ranks #57.

However, Kristof's column reflects something I find quite troubling about the left's concern with "economic inequality." Modern-day progressives appear to be far more concerned with the fact that some people are rich than that some people are poor. You see this throughout Kristof's column. He never once uses the words "poor" or "poverty" in the column, however, he repeatedly complains about the rich:

In my reporting, I regularly travel to banana republics notorious for their inequality. In some of these plutocracies, the richest 1 percent of the population gobbles up 20 percent of the national pie. ...So, let's clear up a few facts here. First, rich people don't make poor people poor. That would only occur if there was a only a fixed amount of wealth in a country. The truth is that economies grow over time. The rate at which they grow depends on how much a country invests in creating new businesses, expanding existing businesses, educating the public, building efficient transportation and communication networks, etc.

The richest 1 percent of Americans now take home almost 24 percent of income, up from almost 9 percent in 1976. ...

C.E.O.’s of the largest American companies earned an average of 42 times as much as the average worker in 1980, but 531 times as much in 2001. Perhaps the most astounding statistic is this: From 1980 to 2005, more than four-fifths of the total increase in American incomes went to the richest 1 percent. ...

So we face a choice. Is our economic priority the jobless, or is it zillionaires? ...

To me, we’ve reached a banana republic point where our inequality has become both economically unhealthy and morally repugnant.

Second, the prospect of becoming rich is one of the main reasons people give up the security of a salaried job in order to create a new business. Starting a new business is risky. Most businesses fail in the first year. Reduce the financial incentive and you will have fewer new businesses, which in turn will create fewer high-paying jobs.

Third, taking money from the rich and redistributing it to the middle class—the progressive agenda ever since Bill Clinton took office—does nothing to help the poor. It's just a modern way of buying votes.

Fourth, Nicholas Kristof's column is misleading because it only focuses on inequality. The problem with Nicaragua, Venezuela and Guyana is not that a few people are rich, it's that the bulk of the population is poor and undereducated. According to the United Nations Development Programme, the United States ranks 9th in the world in terms of per capita income, beaten only by relatively small countries. By contrast, Nicaragua ranks #135, Venezuela ranks #71, and Guyana ranks #128. In terms of education, the United States ranks #5, compared to Nicaragua at #118, Venezuela at #104, and Guyana at #85.

On the overall United Nations Human Development Index for 2010, the United States ranks 4th in the world, beating all 27 members of the European Union.

Personally, poverty troubles me. Inequality does not.

Data source.

Thursday, November 11, 2010

How the poor successfully lift themselves out of poverty

A new paper by Anan Pawasutipaisit and Robert M. Townsend identifies how poor people in Thailand successfully lift themselves out of poverty:

A strong work ethic, a strong education ethic, a strong frugality ethic, and a strong entrepreneurial ethic are essential to improving one's economic well-being. Ethic is a key word here. Parents need to teach their children that these qualities are important, and they need to live it themselves as well.

The full paper can be found here.

The paper, "Wealth Accumulation and Factors Accounting for Success" appears in the current issue of the Journal of Econometrics. It suggests that poor people who skillfully manage their assets are especially successful in improving their net worth. The authors discovered that the ability of poor families to increase their wealth was strongly related with their rate of saving and, even more so, with their ability to create a high return on assets.Most of the qualities identified in the research paper can probably benefit the poor anywhere in the world. When the paper cites a higher ratio of debt to assets, I assume it's referring to borrowing for capital investment, not American-style consumer debt.

This means that those households who used their existing assets most productively were more successful at pulling themselves out of poverty. Many of the successful households reinvested their money in their small businesses and farms, suggesting that they are well aware of the source of their success. ...

The data also allowed the authors to identify traits that the most successful households tended to share in common: more highly-educated household members, a younger age of the head of household, a higher ratio of debt to assets, and a preference for formal financial markets over informal ones. But the largest source of variation in the rate of return on assets was household-specific and uncorrelated with any of these variables. This suggests there is great persistence among the most successful households.

"The data seem to show pretty conclusively that successful households are not just lucky," observes author Robert M. Townsend. "They are doing something systematic, month after month, year after year. The next step, of course, is to figure out what the associated skills and attitudes really are."

A strong work ethic, a strong education ethic, a strong frugality ethic, and a strong entrepreneurial ethic are essential to improving one's economic well-being. Ethic is a key word here. Parents need to teach their children that these qualities are important, and they need to live it themselves as well.

The full paper can be found here.

Tuesday, November 9, 2010

Graph: Taylor Rule vs. Mankiw Rule vs. Fed Funds Rate

This graph compares the Taylor Rule and the Mankiw Rule to the effective Federal Funds Rate. Click on the image to see an enlarged version.

The Taylor Rule and the Mankiw Rule intend to proscribe effective monetary policy, while the Fed Funds Rate is what the Federal Reserve actually did, regardless of whether is was helpful or harmful.

The Taylor Rule and the Mankiw Rule intend to proscribe effective monetary policy, while the Fed Funds Rate is what the Federal Reserve actually did, regardless of whether is was helpful or harmful.

Monday, November 8, 2010

FT: QE2 is about pushing up asset prices

Economist Gavyn Davies, writing for The Financial Times, says this second round of quantitative easing is about pushing up asset prices:

Clearly, the fuss is mostly about asset prices. ... which may encourage the markets to believe that there is a “Bernanke put” underlying the equity market. Almost certainly, the Fed is happy to see rises in equity prices and declines in the dollar, despite warnings that this stance may induce bubbles to develop in the US and overseas.

It is interesting to review market behaviour since Mr Bernanke’s speech at Jackson Hole on 27 August, which indicated that QE2 might be around the corner. Bond yields have hardly moved since that speech, but inflation expectations within the TIPS market have risen by over 0.5 per cent. And commodity and equity prices have risen sharply, by 16 per cent and 11 per cent respectively. These developments are all consistent with a belief that the Fed is intent on reflating the US economy, and that it will succeed in doing so.

Probably the oldest piece of advice in asset management is “don’t fight the Fed”. It usually works. If the economy grows moderately in coming months, while the Fed steadily injects money into the financial system, risk assets could benefit further.

Friday, November 5, 2010

Is the Fed blowing new bubbles?

The Federal Reserve is beginning a new round of quantitative easing, printing money to buy intermediate- and long-term bonds, thus increasing the money supply and lowering intermediate- and long-term interest rates.

This is different from what the Fed normally does to stimulate the economy. Normally it prints money to buy short-term bonds. But, since short-term interest rates are already near zero, the Fed has to take the riskier action of buying longer-term bonds if it wants to stimulate the economy.

Harvard economics professor Martin Feldstein, President Emeritus of the National Bureau of Economic Research, warns that this is dangerous and may blow new bubbles:

Harvard economics professor Martin Feldstein, President Emeritus of the National Bureau of Economic Research, warns that this is dangerous and may blow new bubbles:

As for other notable economists' thoughts on the Fed's actions, John Taylor is opposed and Paul Krugman is ambivalent.

This is different from what the Fed normally does to stimulate the economy. Normally it prints money to buy short-term bonds. But, since short-term interest rates are already near zero, the Fed has to take the riskier action of buying longer-term bonds if it wants to stimulate the economy.

Harvard economics professor Martin Feldstein, President Emeritus of the National Bureau of Economic Research, warns that this is dangerous and may blow new bubbles:

Harvard economics professor Martin Feldstein, President Emeritus of the National Bureau of Economic Research, warns that this is dangerous and may blow new bubbles:The Federal Reserve’s proposed policy of quantitative easing is a dangerous gamble with only a small potential upside benefit and substantial risks of creating asset bubbles that could destabilise the global economy. Although the US economy is weak and the outlook uncertain, QE is not the right remedy.It sounds to me like Feldstein is saying The Onion was right.

Under the label of QE, the Fed will buy long-term government bonds, perhaps one trillion dollars or more, adding an equal amount of cash to the economy and to banks’ excess reserves. Expectation of this has lowered long-term interest rates, depressed the dollar’s international value, bid up the price of commodities and farm land and raised share prices.

Like all bubbles, these exaggerated increases can rapidly reverse when interest rates return to normal levels. The greatest danger will then be to leveraged investors, including individuals who bought these assets with borrowed money and banks that hold long-term securities. These risks should be clear after the recent crisis driven by the bursting of asset price bubbles. Although the specific asset prices that are now rising are different from last time, the possibility of damaging declines when bubbles burst is worryingly similar. ...

The truth is there is little more that the Fed can do to raise economic activity. What is required is action by the president and Congress...

As for other notable economists' thoughts on the Fed's actions, John Taylor is opposed and Paul Krugman is ambivalent.

Saturday, October 16, 2010

Now is the best time for national capital investment

Right now is the best time in decades for the government to engage in long-term capital investment. Investments in education, transportation, communication, and research & development would strengthen the economy in both the short run and the long run. Furthermore, the government's cost of borrowing is the cheapest in my lifetime.

Richard Voith argues the point in The Washington Post.

Richard Voith argues the point in The Washington Post.

Friday, October 8, 2010

Job market: Mixed results for September 2010

The unemployment rate, at 9.6%, remained unchanged in September. Although it is below its late 2009 peak, it has spent almost all of 2010 (except April) in a range of 9.5-9.7%.

Payrolls continued to get worse in September. Ironically, businesses are actually increasing workers. It is governments that are losing workers. John Maynard Keynes must be rolling over in his grave.

On the bright side, aggregate weekly hours worked is increasing. This suggests that underemployment is declining.

Also on the bright side, the mean duration of unemployment has continued to decline after reaching its all-time peak in June 2010.

Payrolls continued to get worse in September. Ironically, businesses are actually increasing workers. It is governments that are losing workers. John Maynard Keynes must be rolling over in his grave.

On the bright side, aggregate weekly hours worked is increasing. This suggests that underemployment is declining.

Also on the bright side, the mean duration of unemployment has continued to decline after reaching its all-time peak in June 2010.

Sunday, August 8, 2010

Should the mosque be built near the World Trade Center site? Yes.

CNN's Fareed Zakaria makes the case:

Ever since 9/11, liberals and conservatives have agreed that the lasting solution to the problem of Islamic terror is to prevail in the battle of ideas and to discredit radical Islam, the ideology that motivates young men to kill and be killed. Victory in the war on terror will be won when a moderate, mainstream version of Islam—one that is compatible with modernity—fully triumphs over the world view of Osama bin Laden. ...

The debate over whether an Islamic center should be built a few blocks from the World Trade Center has ignored a fundamental point. If there is going to be a reformist movement in Islam, it is going to emerge from places like the proposed institute. We should be encouraging groups like the one behind this project, not demonizing them. Were this mosque being built in a foreign city, chances are that the U.S. government would be funding it.

The man spearheading the center, Imam Feisal Abdul Rauf, is a moderate Muslim clergyman. He has said one or two things about American foreign policy that strike me as overly critical —but it’s stuff you could read on The Huffington Post any day. On Islam, his main subject, Rauf’s views are clear: he routinely denounces all terrorism—as he did again last week, publicly. He speaks of the need for Muslims to live peacefully with all other religions. He emphasizes the commonalities among all faiths. He advocates equal rights for women, and argues against laws that in any way punish non-Muslims. His last book, What’s Right With Islam Is What’s Right With America, argues that the United States is actually the ideal Islamic society because it encourages diversity and promotes freedom for individuals and for all religions. His vision of Islam is bin Laden’s nightmare.

Rauf often makes his arguments using interpretations of the Quran and other texts. Now, I am not a religious person, and this method strikes me as convoluted and Jesuitical. But for the vast majority of believing Muslims, only an argument that is compatible with their faith is going to sway them.

Tuesday, August 3, 2010

FBI bullies Wikipedia

From CNN:

From CNN:The U.S. Federal Bureau of Investigation has threatened Wikipedia with legal action if the online encyclopedia doesn't remove the FBI's seal from its site.

The seal is featured in an encyclopedia entry about the FBI.

Wikipedia isn't backing down, however. The online encyclopedia — which is run by a nonprofit group and is edited by the public — sent a chiding letter to the FBI, explaining why, in its view, the FBI is off its legal rocker.

"In short, then, we are compelled as a matter of law and principle to deny your demand for removal of the FBI Seal from Wikipedia and Wikimedia Commons," the Wikimedia Foundation's general counsel, Mike Godwin, wrote in a letter to the FBI, which was posted online by the New York Times. ...

In a letter dated July 22, and also posted online by the Times, the FBI told Wikipedia it must remove the bureau's seal because the FBI had not approved use of the image.

Sunday, August 1, 2010

Monday, June 14, 2010

Paul Krugman was dead wrong

On Friday, Paul Krugman wrote:

So, Paul Krugman was dead wrong. The economy returned to expansion exactly as the yield curve predicted. Furthermore, the yield curve is significantly steeper now than it was in December 2008. That means year-ahead prospects are even brighter now than they were then.

Paul Krugman is a natural economic pessimist. He's such a pessimist that when the economic data shows economic expansion, he tries to confuse his readers by implying that it doesn't.

No matter how Paul Krugman tries to spin it, the yield curve in December 2008 predicted mild economic expansion, and mild economic expansion is what we got. The yield curve is much steeper today.

I wish I could believe in this Macroeconomic Advisers claim that there is a zero chance of a double-dip recession. But when they say that this probabilityIn the second to last paragraph, he is referring to a previous blog post of his from December 27, 2008, in which he wrote:

is estimated as a function of the term slope of interest rates, stock prices, payroll employment, personal income, and industrial productionI immediately lose all confidence.

When short-term interest rates are up against the zero lower bound, a positive term spread tells you nothing; as I explained a year and half ago, it’s something that has to happen given the fact that short rates can go up, but not down.

Failure to understand this point led to excess optimism in late 2008. I’m a bit surprised to see Macroeconomic Advisers falling into the same fallacy now.

I see that economists at the Cleveland Fed are taking some comfort from the positive slope of the yield curve. Long-term interest rates are higher than short-term rates, which is usually a sign that the economy will expand.Paul Krugman may have been right in theory, but he was completely wrong in fact. As Frederic Mishkin has pointed out, the yield curve forecasts economic expansion or contraction roughly four quarters advance. Four quarters after Paul Krugman gave his "Not this time, I’m afraid" argument above, Real Gross Domestic Product showed economic expansion as shown here:

Not this time, I’m afraid. It’s all about the zero lower bound.

The reason for the historical relationship between the slope of the yield curve and the economy’s performance is that the long-term rate is, in effect, a prediction of future short-term rates. If investors expect the economy to contract, they also expect the Fed to cut rates, which tends to make the yield curve negatively sloped. If they expect the economy to expand, they expect the Fed to raise rates, making the yield curve positively sloped.

But here’s the thing: the Fed can’t cut rates from here, because they’re already zero. It can, however, raise rates. So the long-term rate has to be above the short-term rate, because under current conditions it’s like an option price: short rates might move up, but they can’t go down. ...

So sad to say, the yield curve doesn’t offer any comfort. It’s only telling us what we already know: that conventional monetary policy has literally hit bottom.

So, Paul Krugman was dead wrong. The economy returned to expansion exactly as the yield curve predicted. Furthermore, the yield curve is significantly steeper now than it was in December 2008. That means year-ahead prospects are even brighter now than they were then.

Paul Krugman is a natural economic pessimist. He's such a pessimist that when the economic data shows economic expansion, he tries to confuse his readers by implying that it doesn't.

No matter how Paul Krugman tries to spin it, the yield curve in December 2008 predicted mild economic expansion, and mild economic expansion is what we got. The yield curve is much steeper today.

Friday, June 4, 2010

Economy continues to slowly improve

The economy continues to slowly improve, but today's payroll numbers were not as good as expected:

Here is the year-over-year percentage change in aggregate weekly hours worked:

Here is the year-over-year percentage change in initial jobless claims:

Here is the official unemployment rate:

A flood of temporary Census workers in May led to the biggest jump in jobs in ten years, the government reported Friday.Here is the year-over-year percentage change in payrolls:

Employers added 431,000 jobs in the month, up from 290,000 jobs added in April. It was the biggest gain in jobs since March 2000.

But Census hiring was responsible for 411,000 of May's increase in employment. Private sector employers also added 41,000 jobs in the period, well below the 218,000 private sector job gains in April. Government payrolls other than Census declined by 21,000 jobs in May, due largely to job cuts by state and local governments.

It was a disappointing number for private sector hiring, as economists surveyed by Briefing.com had forecast an overall gain of 500,000 in May. U.S. stocks traded sharply lower on the report, with the Dow Jones industrial average down more than 200 points in midday trading. ...